- January 17, 2026

- by admin

- English Speaking, Conversations

- 179 Views

- 0 Comments

How to Practice English in Daily Life: The real magic happens outside of textbooks. Let’s discover how to turn small, natural moments into powerful practice opportunities and make every day an engine of growth for your English skills.

Financial Management for Business Growth

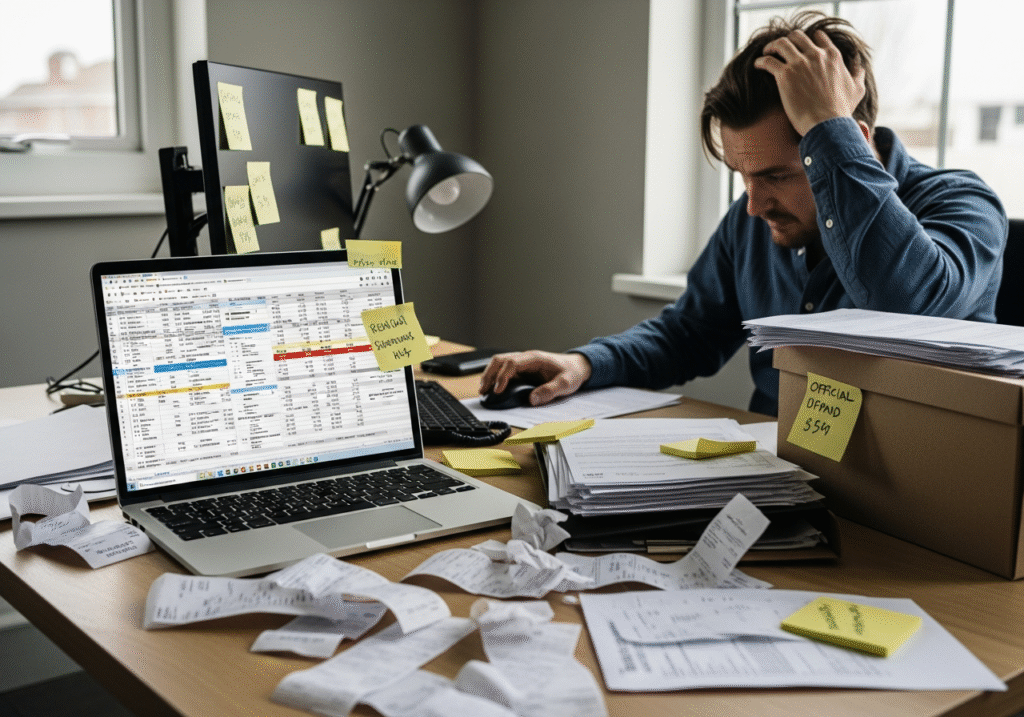

Financial Management for Business Growth: Picture your business as a bucket—no matter how much water you pour in (sales and revenue), if there are leaks, the bucket never fills. Poor financial habits are the often unseen leaks that quietly drain business growth.

What Are Poor Financial Habits?

They can take many forms, including:

- Mixing personal and business expenses

- Not tracking cash flow daily or weekly

- Ignoring budgeting and forecasting

- Delaying payments or chasing overdue invoices poorly

- Avoiding financial reviews due to discomfort with numbers

These habits create uncertainty, stress, and missed opportunities.

Why It Matters

A study by SCORE found that over 60% of small businesses fail due to cash flow problems—not lack of revenue. Good financial management isn’t about being a numbers wizard—it’s about creating clarity and control to make confident decisions.

Turning Financial Habits Around

Start with these practical steps:

- Separate business and personal finances immediately.

- Use simple accounting tools to track income and expenses regularly.

- Set a realistic budget and revisit it monthly.

- Prioritize timely invoicing and collections.

- Schedule routine financial health check-ins, even if brief.

Real-World Example

A small retailer improved cash flow by shifting to weekly expense tracking and proactive collections. This simple habit freed up working capital to invest in marketing, leading to a 20% sales increase within six months.

Key Insights

- Poor financial habits create hidden risks and missed growth chances.

- Clear, consistent management builds confidence and agility

- Financial control empowers smarter, faster business choices.

Action Plan

This week, pick one financial habit to fix or improve. Maybe start daily sales tracking or separate accounts. Watch how small changes create big confidence boosts over time.